Build Your Secure Financial Foundation

Transform uncertainty into confidence with a strategic approach to wealth building that puts protection first.

Transform uncertainty into confidence with a strategic approach to wealth building that puts protection first.

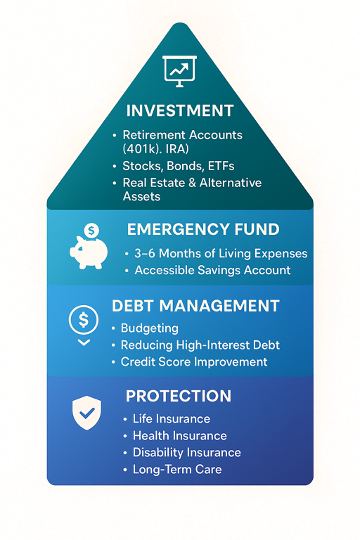

Like building a house, you should start with a solid financial foundation and build it from the ground up. We start with protection, then build systematically toward wealth.

First, you should have proper protection in the event of disability, health problems, or premature death

You should reduce your liability and get out of debt

You should set aside at least 3 to 6 months of your income to deal with sudden changes at your job or business or to pay for unforeseen accidents or repairs

And you should save and invest for the long run. All these tasks should be done as soon as possible

Discover our proven methodology for creating a financial foundation that protects and grows your wealth through every season of life, and it starts off with you.

With years of experience helping families navigate their financial journeys, I believe that true wealth begins with a solid foundation of protection and strategic planning.

My approach combines time-tested principles with modern strategies to help you build not just wealth, but lasting financial security for generations.

Regie Durana is a licensed financial professional affiliated with World Financial Group (WFG). This site is independently operated.